In Quickbooks Online, you can save tons of time with bank rules. There are scenarios where you will have to split a transaction. This could be a split by % or a fixed rate. Either way, bank rules with splits, will allow you to set it and forget it.

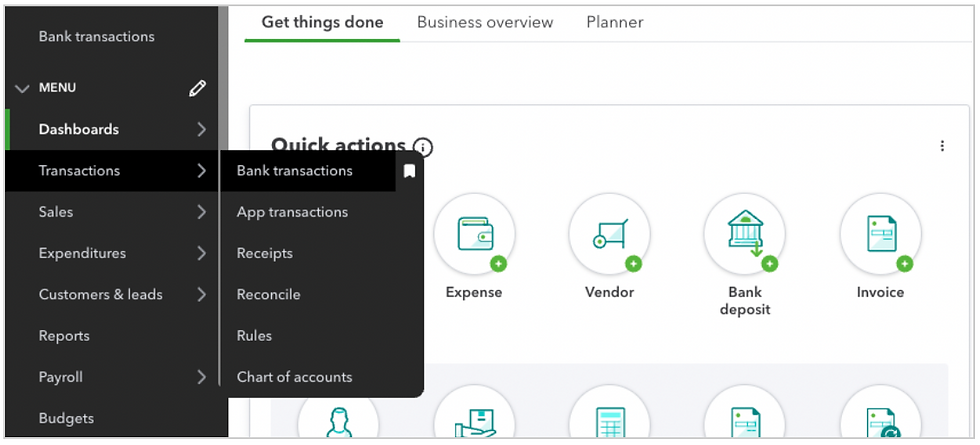

1. Click Transactions → Bank Transactions on the left.

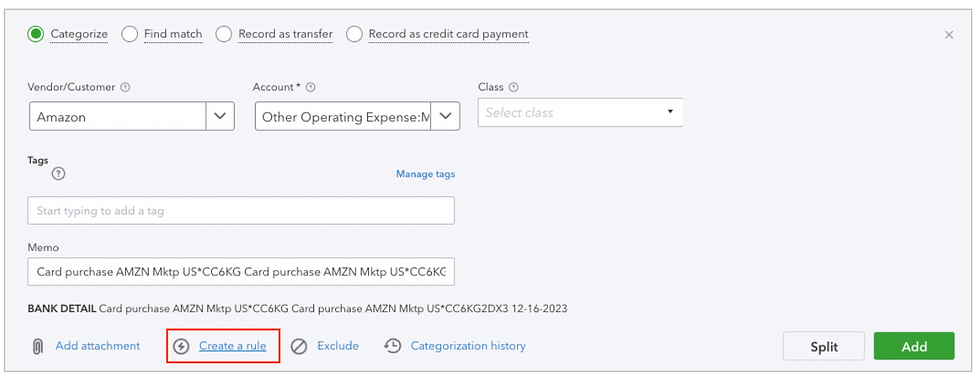

2. If you see a transaction that is recurring, you can create a bank rule in QBO to speed up the process of bank matches. At the bottom of the transaction, click Create rule.

3. Enter in your bank rule name

Apply this to transactions that are: Money in or Money Out

In: Select the bank account this rule pertains to

And include the following:

ALL - If you select ALL, then all of the conditions below must be followed in order for the bank rule to take place.

ANY - If ANY of the conditions below are met, then the bank rule will apply.

In the dropdown, select Description, Bank Text or Amount

Transaction Type: Select Expense, Check or Transfer. In this case this is an expense.

Category: The account the transaction falls under

4. Click Add a Split to split the bank rule. Split it out by percentage % or amount $.

Payee: Company or person you are paying

Tags: Most people do NOT use this. If you use tags, be careful because too many tags can cause confusion.

Class: If you use class and need to put the transaction in one, select it here.

Append to Bank Memo: Add whatever notes you would like

If you would like the text to be whatever the bank says, click the box that says Also keep existing bank memo.

How do you want to apply this rule? You can auto-add which means you will never see these transactions come through in banking. QBO will just push them through for you. If you wish to manually review them, make sure this is toggled off.

Once you create the rule for manual review, you will see this attached to each transaction that has rules applied to them.

This only applies to rules that require approval. Rules that are set as Auto-Add will not show up in the feed as they will be automatically categorized for you.

Check out our video on YouTube.

Comments